What Is The Property Tax Rate In Casa Grande Az . the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. What property tax information are you looking for? in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an.

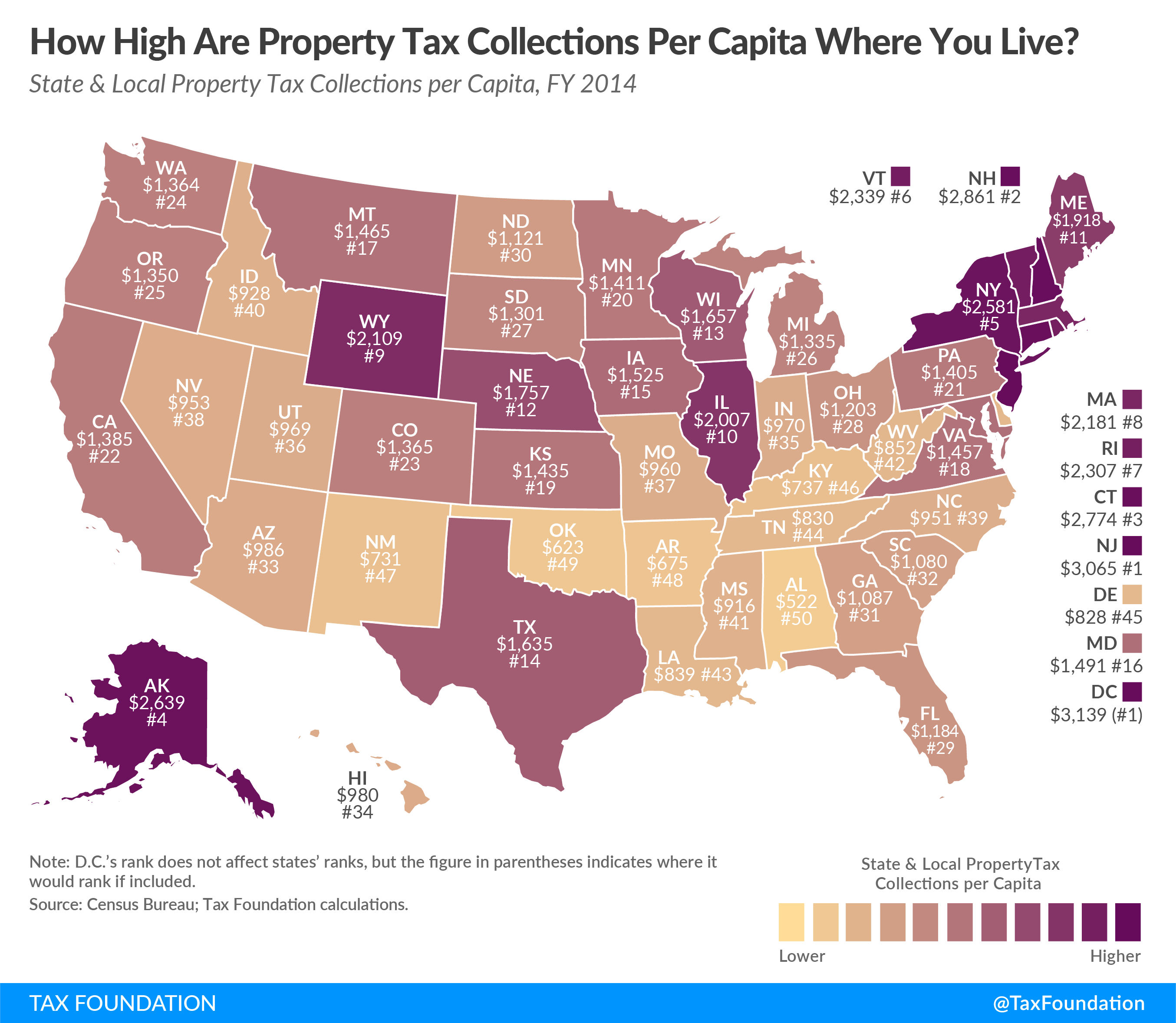

from taxfoundation.org

florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. What property tax information are you looking for? the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an.

How High Are Property Tax Collections Where You Live? Tax Foundation

What Is The Property Tax Rate In Casa Grande Az in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. What property tax information are you looking for? the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%.

From exoxoqdwl.blob.core.windows.net

Property Tax Records Shrewsbury Ma at Benjamin Vandyke blog What Is The Property Tax Rate In Casa Grande Az the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. florence — the pinal county board of supervisors approved new property tax levies and rates monday. What Is The Property Tax Rate In Casa Grande Az.

From www.signnow.com

Arizona Property Tax Rate 20202024 Form Fill Out and Sign Printable PDF Template airSlate What Is The Property Tax Rate In Casa Grande Az in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. florence — the pinal county board of supervisors approved new property tax levies and rates monday. What Is The Property Tax Rate In Casa Grande Az.

From finance.georgetown.org

Property Taxes Finance Department What Is The Property Tax Rate In Casa Grande Az the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. florence — the pinal county board of supervisors approved new property tax levies and rates monday. What Is The Property Tax Rate In Casa Grande Az.

From hxevfebrs.blob.core.windows.net

Casa Grande Arizona Sales Tax Rate at Bryan Martinez blog What Is The Property Tax Rate In Casa Grande Az What property tax information are you looking for? in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. florence — the pinal county. What Is The Property Tax Rate In Casa Grande Az.

From www.investopedia.com

Property Tax Definition, What It's Used for, and How It's Calculated What Is The Property Tax Rate In Casa Grande Az our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. florence — the pinal county board of supervisors approved new property. What Is The Property Tax Rate In Casa Grande Az.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What Is The Property Tax Rate In Casa Grande Az in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. What property tax information are you looking for? . What Is The Property Tax Rate In Casa Grande Az.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans What Is The Property Tax Rate In Casa Grande Az florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%,. What Is The Property Tax Rate In Casa Grande Az.

From tomasinewhedy.pages.dev

States Property Tax Rates 2024 Dacie Dorothy What Is The Property Tax Rate In Casa Grande Az the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. What property tax information are you looking for? the city of casa. What Is The Property Tax Rate In Casa Grande Az.

From constructioncoverage.com

American Cities With the Highest Property Taxes [2023 Edition] Construction Coverage What Is The Property Tax Rate In Casa Grande Az What property tax information are you looking for? florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. the city of casa grande is proposing an increase in. What Is The Property Tax Rate In Casa Grande Az.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation What Is The Property Tax Rate In Casa Grande Az florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem. What Is The Property Tax Rate In Casa Grande Az.

From azgroundgame.org

Arizona’s Mismatched Budget The Arizona Ground Game What Is The Property Tax Rate In Casa Grande Az the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. What property tax information are you looking for? in a legal notice. What Is The Property Tax Rate In Casa Grande Az.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Calculated And Why It Matters What Is The Property Tax Rate In Casa Grande Az the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. What property tax information are you looking for? our primary mission is to locate, identify and appraise at current. What Is The Property Tax Rate In Casa Grande Az.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP What Is The Property Tax Rate In Casa Grande Az in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. What property tax information are you looking for? . What Is The Property Tax Rate In Casa Grande Az.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation What Is The Property Tax Rate In Casa Grande Az in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. the typical arizona homeowner pays just $1,707 in property taxes annually, saving. What Is The Property Tax Rate In Casa Grande Az.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes What Is The Property Tax Rate In Casa Grande Az What property tax information are you looking for? the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. in a legal notice published in the casa grande dispatch, officials unveiled plans to. What Is The Property Tax Rate In Casa Grande Az.

From www.klickitatcounty.org

Property Taxes Explained Klickitat County, WA What Is The Property Tax Rate In Casa Grande Az What property tax information are you looking for? the typical arizona homeowner pays just $1,707 in property taxes annually, saving them $1,088 in comparison to the national average. our primary mission is to locate, identify and appraise at current market value, locally assessed property in pinal county for ad valorem tax purposes (taxation. the city of casa. What Is The Property Tax Rate In Casa Grande Az.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today What Is The Property Tax Rate In Casa Grande Az What property tax information are you looking for? the pinal county treasurer's office is dedicated to providing easily accessible tax information and resources to better help taxpayers understand the. florence — the pinal county board of supervisors approved new property tax levies and rates monday for all. the city of casa grande is proposing an increase in. What Is The Property Tax Rate In Casa Grande Az.

From finance.georgetown.org

Property Taxes Finance Department What Is The Property Tax Rate In Casa Grande Az the city of casa grande is proposing an increase in primary property taxes of $335,246 or 6.79%. in a legal notice published in the casa grande dispatch, officials unveiled plans to hike the primary property tax levy by 6.79%, totaling an. florence — the pinal county board of supervisors approved new property tax levies and rates monday. What Is The Property Tax Rate In Casa Grande Az.